The number and complexity of financial exploitation cases against the elderly has grown significantly over the past decade. Scams targeting senior citizens are extremely prevalent and often go unreported due to the victim’s embarrassment and fear of losing their independence.

Deceptive practices against seniors are perpetrated in person, over the phone, and on the internet, and can be hard to identify especially if the individual is isolated and unfamiliar with common red flags.

Watch Out for Common Deceptive Sales Tactics

Seniors tend to be fraud targets because scammers know that older adults are more likely to have a 'nest egg', have excellent credit and own their own home. Con artists know that prey on victims they believe are less likely to report fraud because of embarrassment or that their relatives will think the victim lack the mental capacity to make good financial decisions. Here are a few common schemes reported by the Federal Bureau of Investigation.

Top Scams

Telemarketing Scams often target people over the age of 60 and with offers of bogus prizes, low-cost medicinal products and services, and travel offers.

Door Knocker Scams target people year round with specific service or product offers. Many seniors have more free time than the average person, which makes them more susceptible to being approached. The offers often turn out to be substandard, cost more than the market rate or do not provide services that were promised.

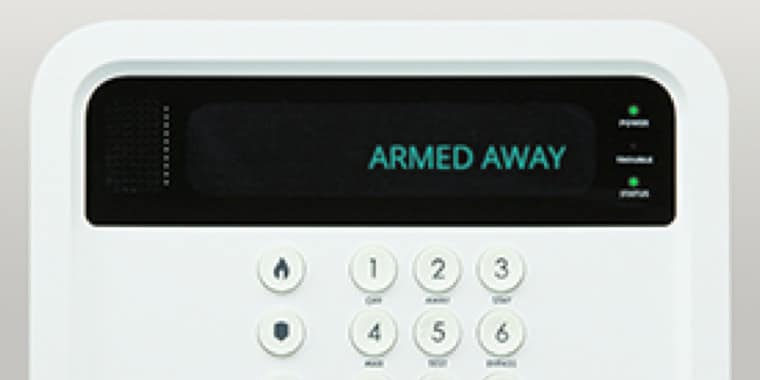

Verify ADT Authorized Dealers

Verify ADT reps

Click here to learn how ADT Customers can protect themselves from fraud.

Common Deceptive Sales Phrases

- “You must act now or the offer will expire.”

- “You've won a free gift, you just pay for shipping and handling.”

- “All you have to do is provide a credit card or bank account number.”

- “We’re here to service your system”

- “Your system is outdated and needs immediate upgrading”

When in Doubt

1. Avoid financial transactions with unfamiliar companies, regardless of how lucrative the offer. If it sounds too good to be true, it usually is.

2. Before making a purchase decision, always request written materials be sent in the mail. Any reputable organization is more than willing to mail information to prospects.

3. Never pay for services in advance or provide payment information for anything that is advertised as "Free.” Companies will never ask you to provide payment for taxes as this is a strict violation of federal law.

4. Do not give in to high-pressure phone sales tactics. When in doubt say, "No, thank you. I am not interested.”

5. If you feel uncomfortable and suspect a scam, hang up the phone or kindly ask the sales individual to leave immediately.

If you believe you may be a victim of fraud, notify your family and contact the local police. Remember, you should never feel ashamed; the people who prey on others are the ones who should be ashamed.