From the implosion of the Fyre Festival to the rise and fall of Theranos, Americans are fascinated by scammers and their schemes. But if tales of high-profile fraud are perversely compelling, more common scam varieties occur regularly nationwide. Some plots pair duplicity with digital technology: Security professionals report a recent surge in phishing attempts. Others target vulnerable individuals, such as the elderly, by any means necessary. While tactics differ widely, one thing is clear: Consumers have a good reason to be vigilant.

In this project, we set out to shed light on the most common and costly schemes occurring across America. Utilizing data from the Better Business Bureau's Scam Tracker℠ database, we analyzed the most prevalent varieties of fraud, both in specific cities and states and the broader nation. Our research also presents the growth of certain scams in recent years and the financial losses associated with each scheme. For an unsparing look at the impact of scams on Americans' pocketbooks, keep reading.

Common Forms of Fraud

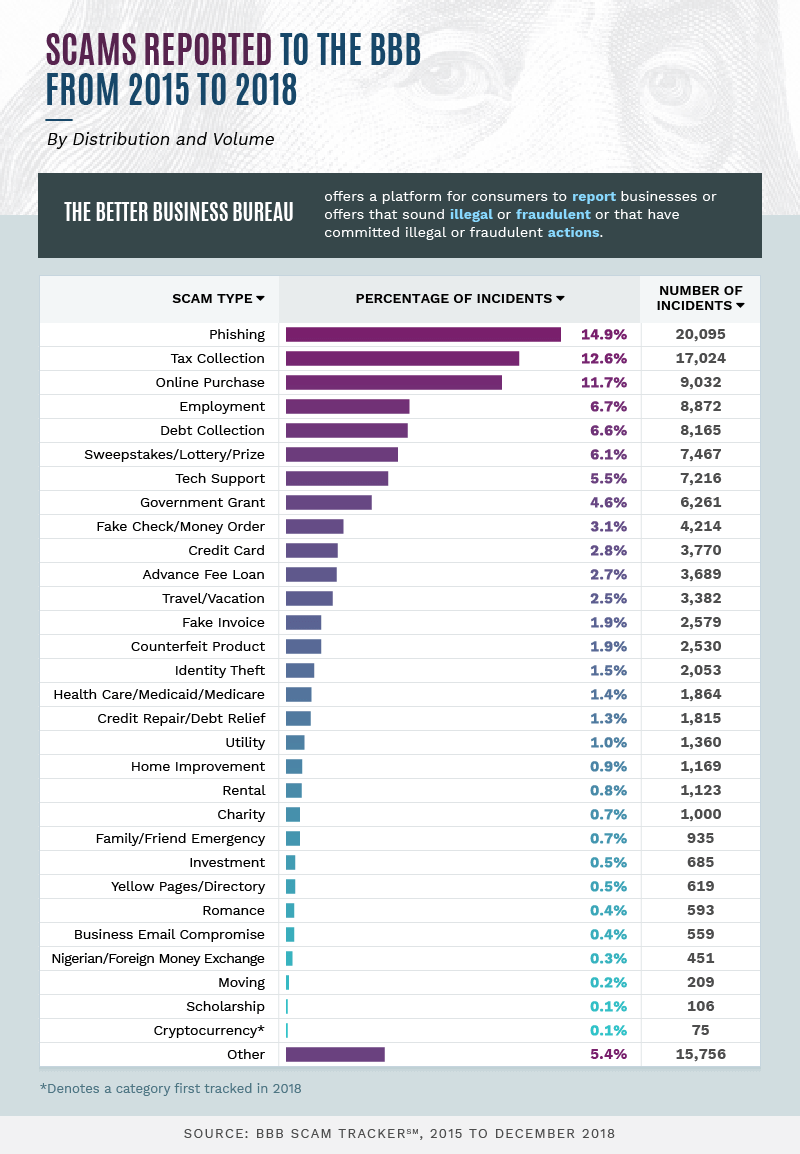

During the period studied, America's most common scam was phishing, the practice of sending fraudulent emails to either obtain sensitive information from unsuspecting recipients – or to infect their computers with malware. Another top scam was also distinctly digital: Online purchase fraud accounted for over 9,000 reported incidents, involving products ranging from pets to cosmetics. In other cases, longstanding schemes have acquired new technological nuances in recent years. In tax collection scams, which encompassed almost 13 percent of all incidents, fraudsters now use digital tools to mimic the official IRS phone number, creating another veneer of legitimacy.

Employment scams were the fourth-most common kind of fraud: Experts say these schemes have flourished in America's tight labor market, mirroring the hiring efforts of legitimate companies. Debt collection scams also accounted for a significant percentage of incidents, as did lottery rackets frequently perpetrated by foreign fraudsters. Meanwhile, tech support scams represented about 6 percent of all incidents, despite recent research from Microsoft suggesting that consumers may be wising up to their ways.

The Costs of Cons

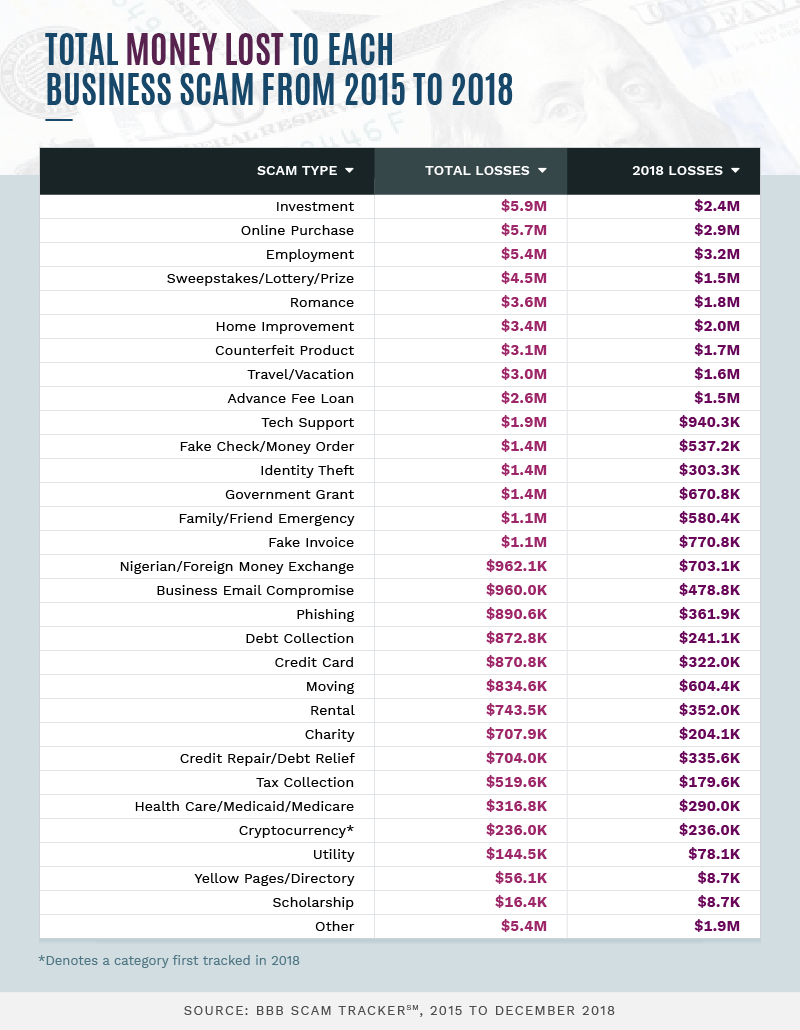

Although phishing schemes occurred most often, investment scams proved most costly overall during the period studied, with consumer losses nearing $6 million. While pyramid or Ponzi schemes are the best-known types of investment fraud, these cons can be quite varied and last for several years. Similarly, scams involving romance are often protracted endeavors and cost victims roughly $3.6 million from 2015 through 2018. Experts say that crooks frequently use online dating platforms to stoke serious feelings, going so far as to plan weddings with their marks before disappearing with their cash.

In some cases, the majority of financial losses associated with a particular kind of fraud occurred in 2018, suggesting a recent uptick in activity. Scams involving health care led to $290,000 in losses in 2018, relative to $316,800 during the entire period we studied. A similar pattern emerged for fake moving companies, which caused over $600,000 in losses in 2018 alone. And despite the widespread infamy of "Nigerian Prince" schemes, money exchange scams from Nigeria and other countries still seem particularly profitable, claiming more than $700,000 in 2018. Psychologists say plots of this variety ruthlessly exploit human beings' cognitive vulnerabilities, so scammers working this angle will never lack for potential victims.

Lucrative Lies

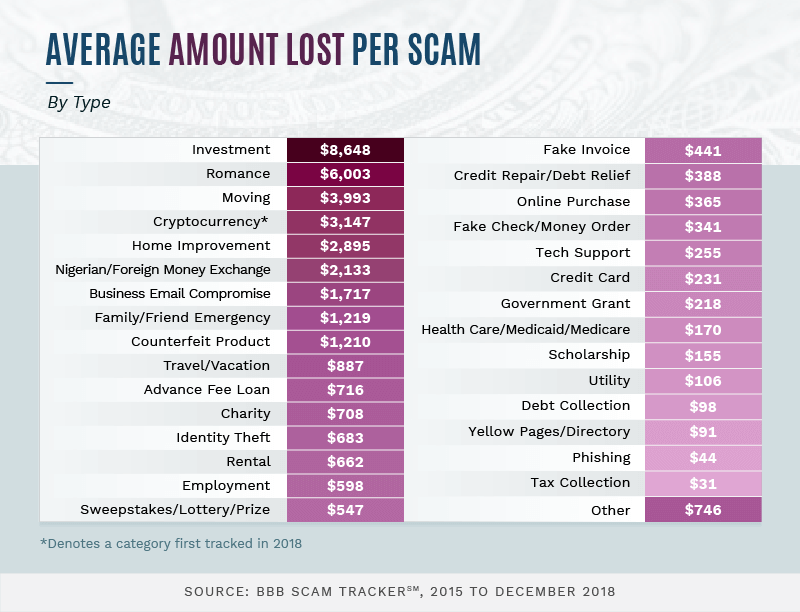

In terms of average losses per scam, investment and romance schemes were the most damaging by far. Moving scams also robbed victims of nearly $4,000 on average (consumers put down a hefty deposit, but the movers never show up). Cryptocurrency scams also accounted for over $3,000 on average. Nefarious plots abound in the continually evolving blockchain industry, often with costly consequences. Some of the most effective schemes involve the hacked Twitter accounts of industry leaders or public figures, lending credibility to their dubious cryptocurrency giveaway claims.

At the other end of the spectrum, however, some of the most common schemes cost individual victims relatively little. In tax collection, phishing, yellow pages, and debt collection scams, the individuals affected typically lost less than $100. This trend may explain why so few individuals report being scammed; according to one estimate, just 14 percent of victims contact authorities. When you've lost only a small sum, embarrassment or a sense of futility may outweigh your desire to see the fraudsters brought to justice.

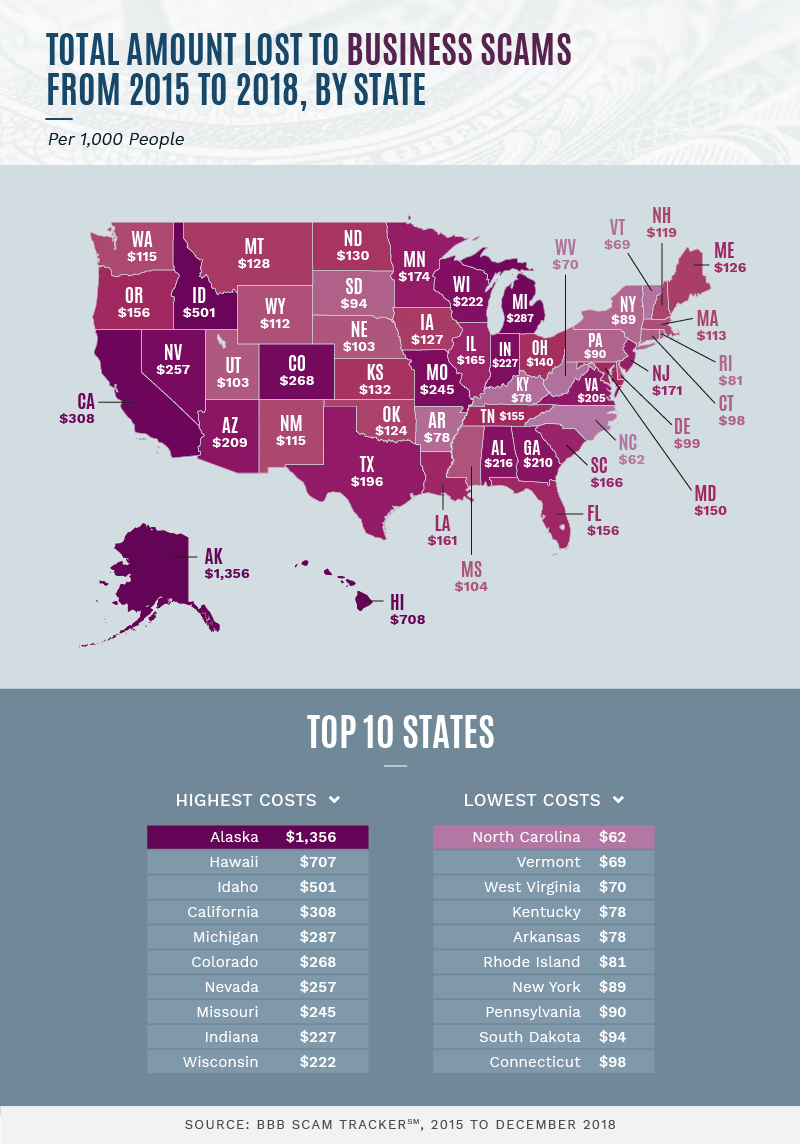

Swindled States

Across the country, where have residents lost the most money to scams? In Alaska, where tricksters have recently used unnervingly personal tactics to defraud their victims, scam losses amounted to more than $1,300 per 1,000 people. In Hawaii and Idaho, losses also exceeded $500 for every thousand residents. California's per-capita losses were quite large as well. Authorities say that Los Angeles and neighboring cities are hotbeds for a wide array of fraudulent activities, from identity theft to faked kidnappings.

In many states, however, losses totaled less than $100 per 1,000 residents. North Carolina was particularly fortunate in this regard, although the state hardly lacks for scams of its own. Vermont had similarly limited losses, which is particularly impressive given the state's aging population (scammers frequently target older adults). Much of Appalachia sustained relatively minor losses as well: West Virginia, Kentucky, and Pennsylvania lost $90 or less per 1,000 residents.

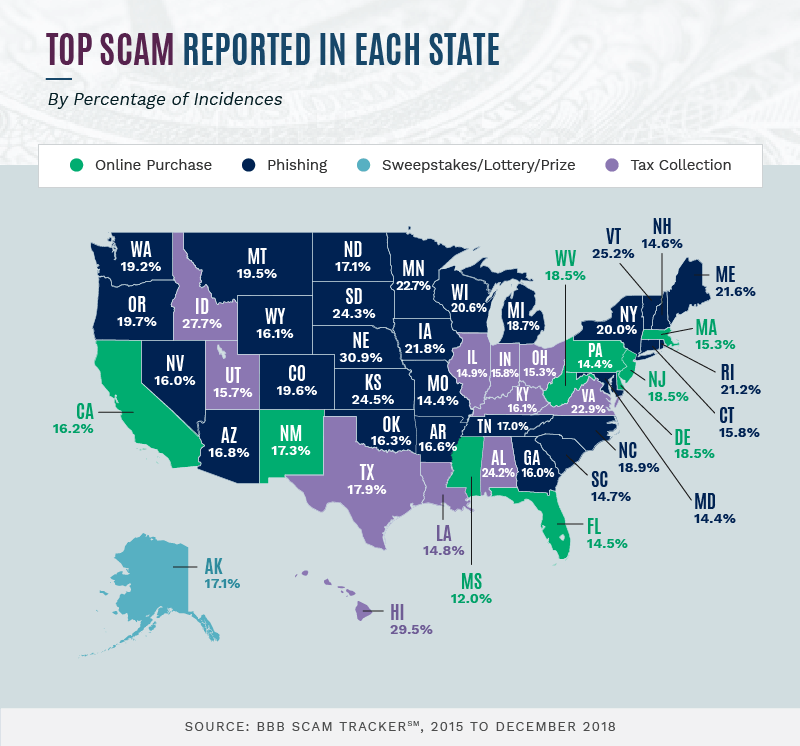

Duplicit Geography

In most states, phishing was the most common scheme – accounting for more than 1 in 5 scams in several places. Given the alarming prevalence of phishing attempts (roughly 1 in every 101 emails sent, according to some experts), the nationwide scale of the problem is unlikely to fade in the coming years. In some of the nation's most populous states, however, online purchase fraud caused greater problems. This was the case in Florida, California and Pennsylvania, where schemes involving online shopping accounted for approximately 15 percent of all scams.

In 11 states, tax collection schemes were the most pervasive fraud. It's worth noting that tax scams can vary significantly in their execution and outcomes: While one variation may cause trouble in Idaho, a slightly different ploy could wreak havoc in Hawaii. Meanwhile, Alaska was the lone state in which lottery, sweepstakes, or prize scams were the most common. One such plot created a public relations problem for Alaska Air: In 2016 and again in 2018, scammers impersonated the airline, offering nonexistent free tickets on Facebook.

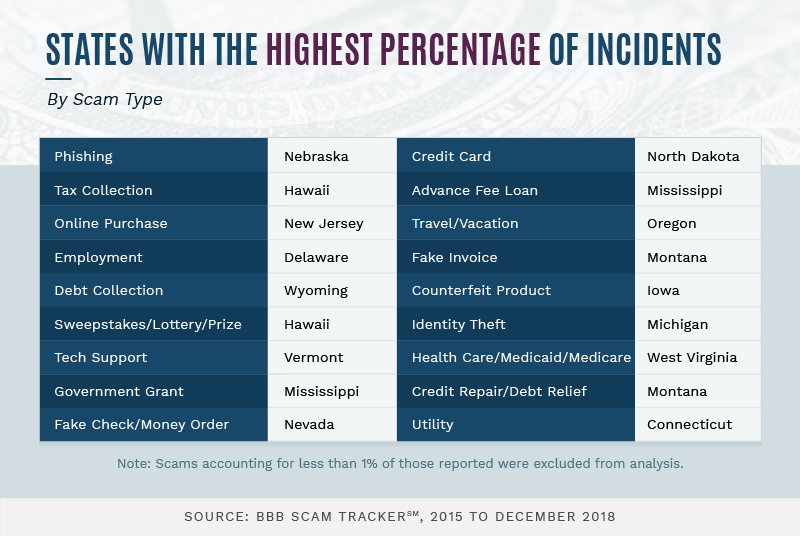

Top State for Each Scheme

Relative to other parts of the country, which states are hotbeds for particular types of fraud? Some states had the misfortune of leading the nation in multiple forms of deception: Mississippi, for example, was the top state for both government grant scams and fraud involving advance fee loans. Likewise, Montana led all states in credit repair or debt relief schemes and fake invoice scams (a specific form of phishing that has been used by fraudsters for some time). Additionally, Hawaii had the misfortune of experiencing more tax collection and lottery scams than other states.

In some cases, rampant scam activity has prompted authorities to reconsider their enforcement approaches. In West Virginia, which led the nation in health care scams, the state's attorney general has called for Medicaid fraud investigations to be moved under his purview. In Michigan, which saw more identity theft scams than any other state, legislators passed new measures to curb the use of stolen identities in unemployment insurance fraud. Elsewhere, though, police and impersonated companies can do little more than raise awareness. In Connecticut, for example, utility scams remain a recurring challenge, despite light and gas companies' warnings to their customers.

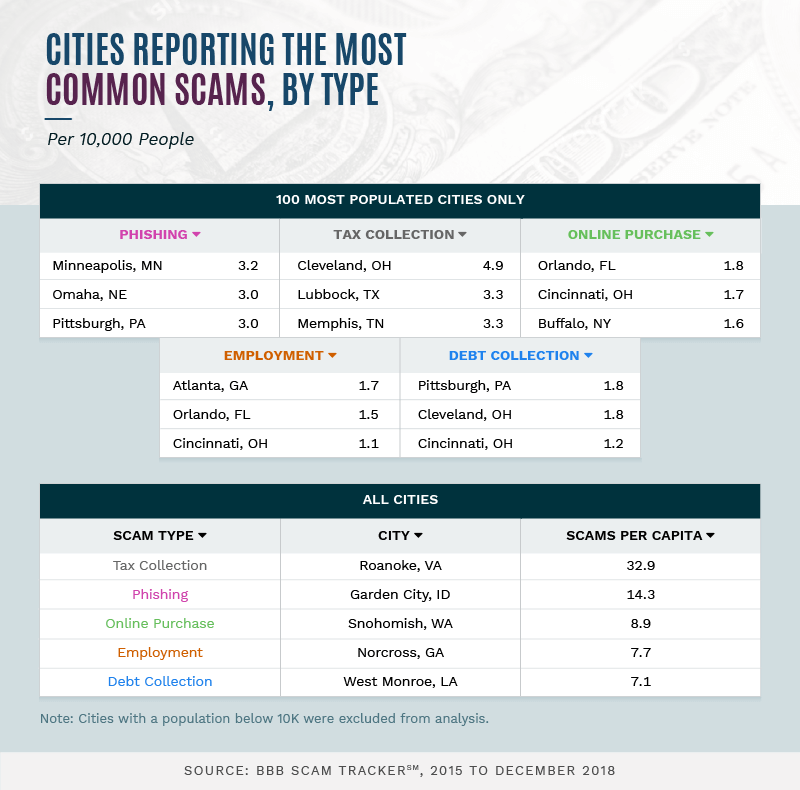

Scam Cities

When we analyzed the prevalence of scams in America's 100 largest cities, two Ohio locations stood out. Cleveland had the nation's highest per-capita rate for tax collection and second-highest rate for debt collection scams, while Cincinnati ranked second for online purchase fraud and third for employment and debt collection schemes. Pittsburgh also claimed multiple spots, tying for first in debt collection scams and ranking third for phishing. In one elaborate phishing scam, Pittsburgh residents received an email that appeared to be from Amazon. Once victims entered their passwords, they were redirected to the real Amazon site – with no indication that their login credentials had been stolen.

Broadening our analysis to include all cities with 10,000 or more residents, however, we found some smaller cities had much higher scam rates per capita than major metropolitan areas. In Roanoke, Virginia, for example, tax collection scams were overwhelmingly common, with almost 33 complaints per 10,000 residents. Garden City, Idaho, home to approximately 12,000 residents, led the nation in phishing incidents. In an age where fraudsters rarely interact with their victims in person, these data confirm that no corner of the country is beyond the reach of scammers.

Scam Tactic Timeline

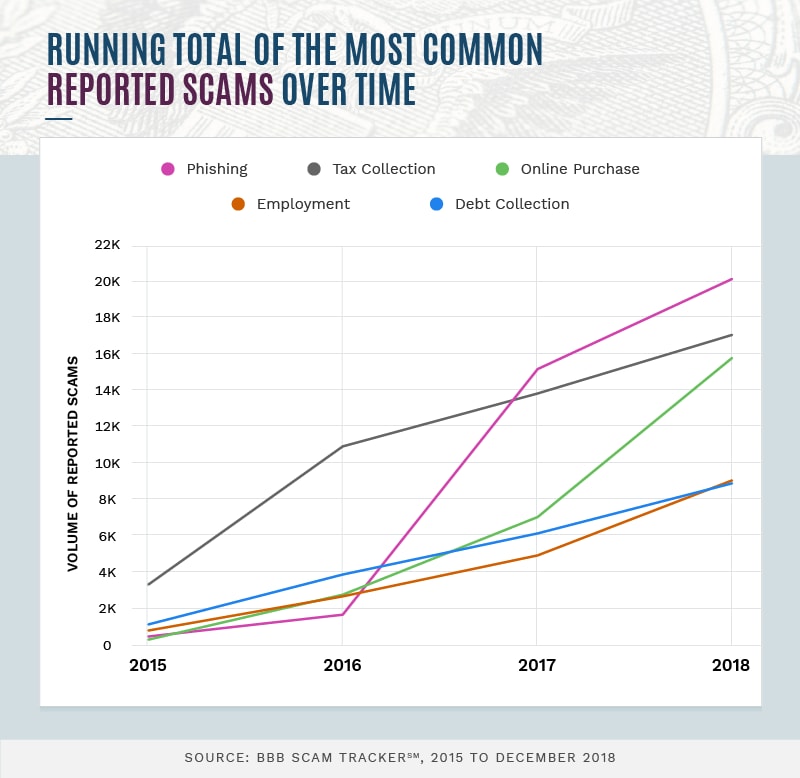

In chronological terms, trend lines for common scams differed substantially. Moreover, certain years saw specific scams suddenly spike. In 2016, for example, there were 1,658 phishing incidents; the following year, there were 15,147. Similarly, online purchase scams doubled between 2017 and 2018. Debt collection scams had a relatively incremental rise between 2015 and 2018, likely powered by a corresponding uptick in robocalls, a favorite tool of fraudsters. According to some estimates, new technologies have driven scammers' costs down to as little as a cent per call.

Surging Scams

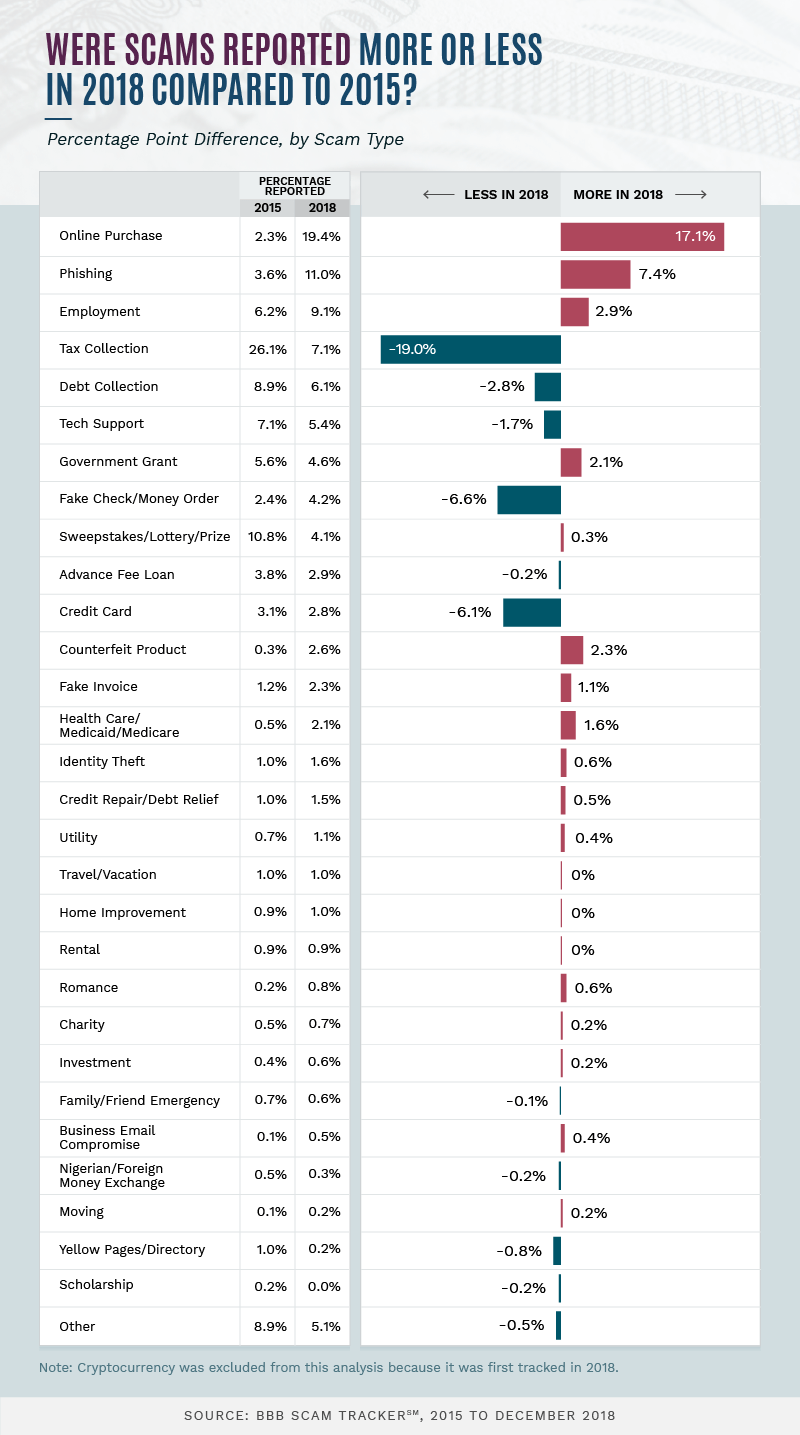

While most scams increased only modestly between 2015 and 2018, online purchase schemes and phishing attempts increased by 17 percent and 7 percent, respectively, during that period. Conversely, tax collection schemes declined precipitously during that time (authorities credit the 2016 arrest of a tax scam ringleader based in India). Reports of tech support scams also dipped slightly, perhaps due to help from the private sector. Since 2015, Google and Microsoft have each taken steps to combat fraudulent tech support companies.

Reports involving fake checks and credit card scams were also less frequent in 2018 than in 2015. These issues can hardly be considered resolved, however: Fake checks still feature prominently in employment schemes and prize scams, while millions of card numbers are stolen every month. Moreover, our data suggest scam trends are largely unpredictable. In any year, new technology or an angle may return a dormant scam to widespread use.

Powerful Protection: For Your Finances and Family

As our findings suggest, scams continually evolve over time, incorporating novel tools and exploiting new vulnerabilities. And while phishing or tax collection schemes may make headlines at any time, focusing on particular schemes may prove insufficient. Rather, Americans must remain vigilant in all their transactions, diligently checking payment details. Moreover, they can invest in prudent protections against scammers' efforts – and stay ahead of the next wave of tricks.

One such tool is identity theft protection, which guards your personal information against bad actors online. ADT offers affordable and effective identity theft protection packages, including extensive monitoring and expense reimbursement in cases of fraud. For decades, we've helped millions of families feel safe in their homes. Let us provide that same peace of mind by keeping you safe from scammers.

Methodology and Limitations

We collected data from the Better Business Bureau's BBB Scam Tracker℠ from 2015 to December 2018. The portions of the data used for this project included reported scam types and dollar losses sustained by victims of the scams. Categories that occurred less than 1 percent of the time for the duration of the dataset were grouped into the "Other" category for the graphic titled "States With the Highest Percentages of Incidents." Cryptocurrency was excluded from the graphic titled "Were Scams Reported More or Less in 2018 Compared to 2015?" due to its short time span in which there were no reported incidents from 2015 to 2017. Cryptocurrency was first tracked in 2018. The data were accessed in December of 2018. Per-capita figures were calculated with the 2017 U.S. census data for states and cities. Cities with a population below 10,000 residents were excluded from analysis.The content presented in the BBB Scam Tracker℠ is self-reported by victims or potential victims. Self-reported data potentially introduce issues such as exaggeration, selective memory, and attribution, among other things.

Sources

- https://www.vox.com/the-goods/2019/1/18/18187373/fyre-festival-netflix-maria-konnikova

- https://www.pcmag.com/news/366210/beware-phishing-attacks-are-on-the-rise

- https://www.marketwatch.com/story/these-common-scams-target-the-elderlyhow-to-avoid-them-2018-11-15

- https://www.consumer.ftc.gov/blog/2018/12/netflix-phishing-scam-dont-take-bait

- https://www.adt.com/resources/prevent-phishing

- https://www.cnbc.com/2018/06/14/online-shopping-can-be-a-minefield-of-scams-heres-how-to-protect-yourself.html

- https://www.forbes.com/sites/kellyphillipserb/2018/04/25/irs-warns-on-yet-another-new-twist-on-tax-phone-scams/#7ab326ce7379

- https://www.cnbc.com/2018/11/08/employment-scams-are-on-the-rise-in-tight-labor-market.html

- https://www.consumer.ftc.gov/articles/0086-international-lottery-scams

- https://www.pcmag.com/news/364538/tech-support-scams-still-a-problem-but-things-are-improving

- https://www.bbb.org/article/news-releases/16921-bbb-tip-investment-scams

- https://www.consumer.ftc.gov/blog/2018/07/online-love-asking-money-its-scam

- https://www.bbb.org/article/news-releases/16917-bbb-tip-moving-scams

- https://www.psychologytoday.com/us/blog/out-the-ooze/201808/why-we-still-fall-the-nigerian-prince-scam

- https://www.bbb.org/article/news-releases/16917-bbb-tip-moving-scams

- https://thenextweb.com/hardfork/2018/12/27/2018-cryptocurrency-scams/

- https://www.consumerreports.org/scams-fraud/scam-or-fraud-victim-what-to-do/

- https://www.ktva.com/story/37779129/alaska-scams-getting-more-personal-state-warns

- https://www.ocregister.com/2018/02/15/southern-california-scammers-are-out-to-get-your-money-and-torment-your-lives/

- https://patch.com/north-carolina/charlotte/police-warn-nc-scam-threatening-arrest-state-fines

- https://www.wgbh.org/news/national-news/2018/06/27/why-vermont-is-tackling-its-population-problem-one-grant-award-at-a-time

- https://www.usatoday.com/story/money/personalfinance/2018/03/17/more-fraudsters-scamming-senior-citizens-through-technology-and-its-costing-them-millions/428406002/

- https://www.zdnet.com/article/phishing-warning-one-in-every-one-hundred-emails-is-now-a-hacking-attempt/

- https://www.forbes.com/sites/kellyphillipserb/2018/03/06/phone-scams-remain-on-irs-dirty-dozen-list-of-tax-scams/#3d0a7eb6182d

- https://www.adn.com/business-economy/2018/01/11/alaska-air-is-not-giving-away-free-tickets-no-matter-what-facebook-says/

- https://www.consumer.ftc.gov/blog/2018/02/phishers-send-fake-invoices

- https://www.wtap.com/content/news/WV-Attorney-General-in-favor-of-Medicaid-fraud-unit-redesignation-504945461.html

- https://www.crainsdetroit.com/article/20180409/news/657441/michigan-sees-spike-in-identity-theft-complaints-improves-unemployment

- https://www.ctpost.com/local/article/Utility-companies-warn-of-scam-13393448.php

- https://factfinder.census.gov/bkmk/table/1.0/en/PEP/2017/PEPANNRES/1620000US1629620

- https://www.marketwatch.com/story/heres-why-youre-getting-so-many-spam-phone-calls-2018-10-12

- https://www.bbb.org/article/news-releases/17202-online-purchase-scams-are-the-riskiest-type-of-fraud-according-to-2017-data-from-bbb-scam-tracker

- https://www.engadget.com/2018/09/02/google-widens-crackdown-on-ads-for-tech-support-scams/

- https://www.forbes.com/sites/leemathews/2018/12/05/microsoft-puts-the-hurt-on-windows-tech-support-scammers/#50044ae63932

- https://www.nbcnews.com/better/business/scammers-use-fake-checks-steal-tens-millions-dollars-each-year-ncna906521

- https://arstechnica.com/information-technology/2018/11/why-arent-chip-credit-cards-stopping-card-present-fraud-in-the-us/

Fair Use Statement

When it comes to fighting scams, information is the best prevention. Accordingly, please share this project with others to help raise awareness of common scams across America. We do have two simple requests: First, please only use this content for noncommercial purposes. Second, include a link back to this page whenever you share this project, so that others can explore our full findings.

© 2019 ADT LLC dba ADT Security Services. All rights reserved. ADT, the ADT logo, ADT Always There and 800.ADT.ASAP and the product/service names listed in this document are marks and/or registered marks. Third party marks are the property of their respective owners.